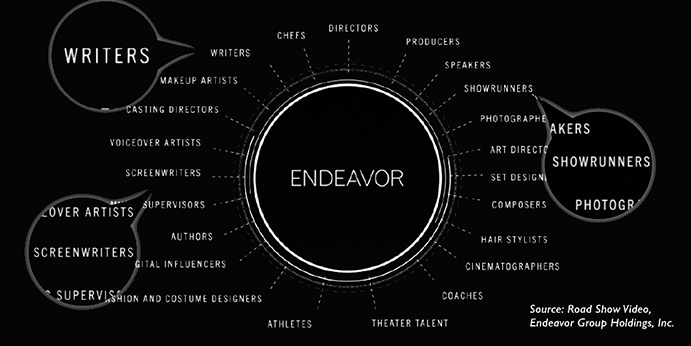

Endeavor launches its IPO on Friday, September 27th, in a cash grab for Endeavor’s CEOs and a raw deal for public investors. By going public, Endeavor compounds the existing conflicts in its representation business and brings talent one step closer to a future much like the old, exploitative studio system. On the day the company goes public, let’s show why writers, and investors, should be concerned by this #RiskyEndeavor.

Use the graphics and sample language below, or create original posts with the hashtag #RiskyEndeavor.

THEME 1: ENDEAVOR HAS LOST 1,400 TELEVISION AND FILM WRITER CLIENTS SINCE APRIL 2019

Graphic

Download for Twitter

Download for Facebook

Sample Social Posts

- 1,400 writer clients walked away from @WME in April to bring an end to its conflicted practices. Until it can end these conflicts, @WME’s representation business is at risk of disruption—one of many reasons investors should beware of this #RiskyEndeavor.

- .@WME’s loss of 1,400 writer clients compounds its weak performance and high leverage. Now they want $$$ from public investors. Proceeds from Endeavor IPO will go towards pay down debt, not to creating value for shareholders. #RiskyEndeavor

Articles

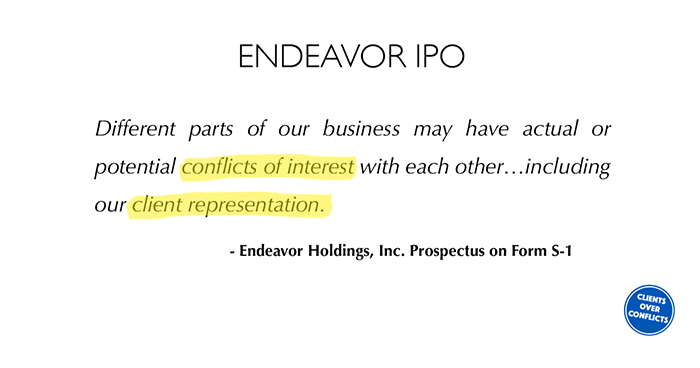

THEME 2: ENDEAVOR’S PACKAGING FEES AND CONTENT PRODUCTION VIOLATE FIDUCIARY DUTY AND THREATEN ITS REPRESENTATION BUSINESS

Graphic

Download for Twitter

Download for Facebook

Sample Social Media Posts

- Hey @WME, here’s one thing we can all agree on! Over 1400 of your #WGA clients walked away over your conflicted practices of packaging fees and affiliated content production. This is one #RiskyEndeavor.

- Endeavor’s SEC filing is clear as day. @WME conflicts of interest make its IPO a #RiskyEndeavor

- Hey #WallStreet: If #Endeavor treats stockholders the same way they’ve treated their own clients, the #EndeavorIPO will be a bad investment. Learn about how they’ve been violating their fiduciary duty to clients. #Risky Endeavor https://www.youtube.com/watch?v=v5p6urW6c7I

Articles

THEME 3: ENDEAVOR IS FACING A FEDERAL LAWSUIT OVER ILLEGAL PACKAGING FEES, PRICE-FIXING BEHAVIOR

Graphic

Download for Twitter

Download for Facebook

Sample Social Media Posts

Articles

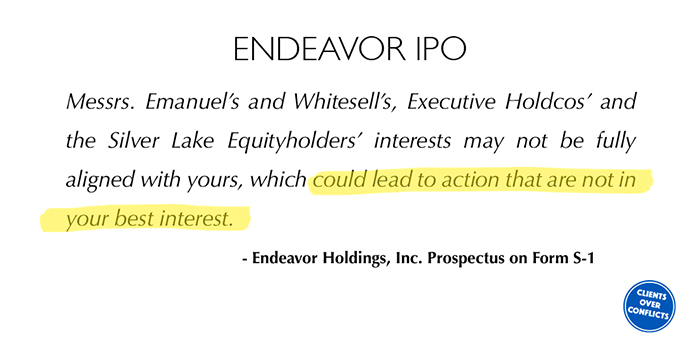

THEME 4: ENDEAVOR’S STOCK STRUCTURE DISADVANTAGES INVESTORS

Graphic

Download for Twitter

Download for Facebook

Sample Social Media Posts

- Endeavor’s governance structure would give all the power to its top executives and private equity investors. Great news for @AriEmanuel & co. Bad news for shareholders and clients! #RiskyEndeavor

- .@WME’s business practices enrich executives at the expense of their own clients. Now they are playing the same tricks on investors, with a governance structure that frees top executives from shareholder oversight. Conflicts of interest—with clients and investors—make for a #RiskyEndeavor.

- The stock #Endeavor wants to sell you isn’t the same as the stock they keep for themselves. Dual-class stock and anti-takeover provisions make this IPO a #RiskyEndeavor https://www.sec.gov/news/speech/perpetual-dual-class-stock-case-against-corporate-royalty#_ftnref20

Articles

THEME 5: THE NUMBERS DON’T ADD UP FOR ENDEAVOR’S IPO

Graphic

Download for Twitter

Download for Facebook

Sample Social Media Posts

- #Endeavor claims to represent writers, but investors should know they’ve lost 1,400 TV and film writer clients since April 2019. I wonder why they didn’t mention that it their roadshow video for the #EndeavorIPO? #RiskyEndeavor

Looking for a deeper dive into the facts about Endeavor? Check out our fact sheet on the topics listed above.